I recently had the pleasure to hold a keynote for our good friends at e27 to open their series of webinars on fundraising fundamentals. The topic at hand was about fundraising in our “new normal” made (mostly) of online/digital interactions. I am sharing below the main messages and take-aways.

Key questions to ask yourself before fundraising

While there are of course some specifics about fundraising online or remotely, there are some fundamental questions (5) around fundraising that I feel every founding team should ask themselves before starting to actually fundraise (digitally or not). You might not have clear and definite answers to all of them when you start fundraising (and the answers can change over time), but spending time to find answers will help you structure your approach and focus your effort and energy more efficiently.

- Why?

This could sound almost like a dumb question but you would be surprised by the number of founders who actually are not too sure why they are raising money (especially at very early stage), or worse are raising money for the wrong reasons (hint: ego).

I am not talking about your use of funds (e.g.: hiring people, marketing campaigns etc.), but more fundamentally why does your business need external money? Why isn’t it possible to bootstrap? Why do you want to “accelerate” and give away significant shareholding of your company vs. growing steadily your business and retain full ownership?

2. When?

Whether you have already raised 3 rounds or it’s going to be your first time fundraising, a good indicator of when to start fundraising is your runway (how much time you have left before running out of cash with your current spend behavior). A good ballpark estimate is to start at least 6 months before your run out of cash. Yes you hear stories of companies raising in 2 weeks and yes these are usually true, but there is an equal (if not higher) number of companies which take 9 months or even a year to raise, and you never heard of them — don’t take chances.

3. How much?

How much money is quite straightforward: you should raise enough money to enable you to reach your target for the next 18 months or so. Whether it’s for hiring talents, investing in R&D or buying assets, launching marketing campaigns etc., the breakdown of your use of funds should be clear and realistic, with some buffer.

Then how much are you ready to give away of your company in terms of shareholding (%) is up to you to decide, although market practice makes it around 20–25% at early stage (pre-A, A, B), and the valuation is derived from there.

4. Who?

This question is quite important to help you focus your go to market efforts: the better you narrow down the investors you want, the least time you will waste talking to people who are not a good fit for you to begin with. As the saying goes, not every dollar is equal.

You can break down this question into 2:

- Who = what type of investors: VCs, family offices, angel investors, banks, venture debt etc. All these players are able to infuse cash into your business but it comes with different contraints and relationship dynamics.

- Who = which entities. For instance if you go the VC route, get to know each fund focus industries, geographies, stage etc. and then prioritize the ones your really want to target.

5. How?

This is more related to fundraising tactics and planning: how to reach out to the VCs you want the most ?(cold email? webinar invite? enroll to accelerator program?) What do you want to cover in your deck and in the first meeting? What to put in your data room?

The best way to find out is to talk to other founders who have been through the journey before you (and are ideally invested by your target investors), so they can give you the right tips and tricks.

Fundraising in the “new normal”

Now that you have asked yourself (and hopefully, answered!) the key questions above, you should keep in mind the following points that are specific to the digital world we now have to live in.

- It is more difficult to connect informally with VCs

While networking events used to be the norm (Keynotes, Demo Days, Get together etc.), online networking is much less efficient and natural than online, and when you step in that 1st video call, the transaction begins - You might be the 10th meeting of the day

Working from home + video calls = more back-to-back meeting = less mental freshness - You might not be able to properly showcase your product

Hardware companies are clearly at a disadvantage, but even software companies can sometimes struggle to provide a simple demo of their product - Attention span is lesser

People are much more prompt to multi-tasking when on a videocall than in face to face. You think it’s impolite to check your text messages during a face to face meeting? It is as well during a video meeting, yet people keep on doing it so be prepared (and don’t take it personally).

The key is to keep your interactions engaging for the other party. Make it a conversation, ask questions, do a product demo, ask your counterpart to use the product live etc. There are many different ways to keep the level of interest of the audience high and these are key in making a difference as soon as the first introductory meeting.

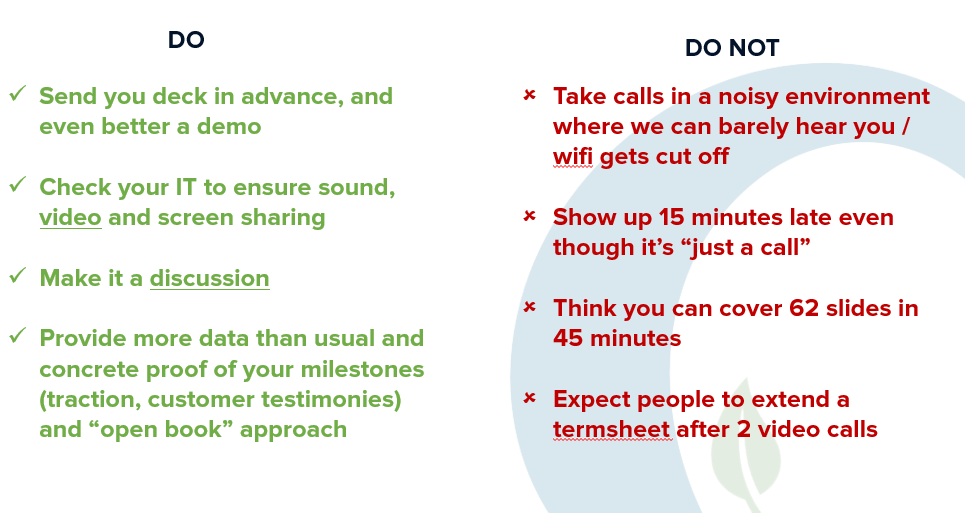

Do’s and Don’ts of digital fundraising

I would like to put an emphasis on the last (but not least) Do: share as much as you can with potential investor’s. If you want to sign NDAs, do it (although it’s more for the peace of mind than anything else, really — the gentleman code is to not share confidential information anyway), but share share and share.

You should understand that pre-Covid, VCs would fly all over the region to go on the ground and visit startups in their office, irrespective of them being 2 people or 200. We would spend time with the teams to understand the company culture, the internal processes, the dynamic between co-founders etc. All of this intangible is much more difficult to assess through a screen, so the more data you can share with investors, the better they can build their case internally to land you a potential investment!

Despite the excessive amount of money flowing into Southeast Asia, fundraising is tough exercice, but necessary if not critical for most startups, so preparation is key.

I hope this quick summary will be useful to you founders, whether you are pre-seed or Series B and beyond, as I believe these principles apply at any stage, and any level of “hype” or media coverage!