“According to the Asia-Pacific Artificial Intelligence Market 2016-2022 report, the adoption of Artificial Intelligence (AI) in the Asia-Pacific region is estimated to grow by almost 47% between 2016 and 2022. Another research suggests that the Big Data market in APAC is likely to progress at a rate of 21.42% CAGR between 2019-2027.

Advanced tech disruptions are happening across all sectors today and innovations enabled by AI and Big Data are spearheading the 4.0 revolution making the on-demand software market even more robust as users get access to extremely personalised SaaS solutions — from online shopping to banking to ride-hailing and even to healthcare consultations. No wonder why the APAC SaaS market is expected to grow at a compound annual growth rate of 34.28% during the forecast period of 2018-2023.

While the entire world has been riding the tech wave with the APAC emerging as a hub for innovation and disruptions, 2020 has been a year of reality check highlighting infrastructural gaps and lack of digitalisation across different sectors. It has become clearer that to truly future-proof businesses across industries, there is a dire need to encourage founders that lead startups with innovation at the core and this is where venture capital firms like Qualgro are taking the lead.

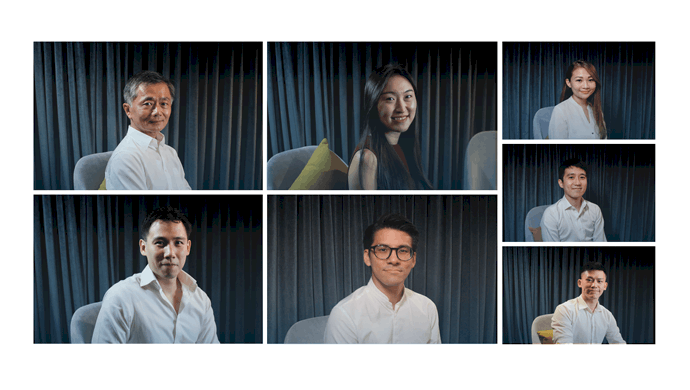

Qualgro is a Venture Capital firm based in Singapore, investing mainly in B2B companies in Data, SaaS, and AI to support talented entrepreneurs with regional or global growth ambitions. Qualgro invests across Southeast Asia, Australia, and New Zealand, primarily focusing on Series A and B.

Despite the pandemic, they have been quite active, having made four investments across the region this year so far. This is followed by a significant exit they had last year as anchor investor with the acquisition of Wavecell by a US-listed company for US$125 million. This was voted ‘Exit of the Year 2019’ by the Singapore Venture Capital Association.”

Read more at https://e27.co/why-covid-19-isnt-slowing-down-this-vc-from-helping-businesses-scale-20201005/